Thanks for stopping by to check out the latest updates for 2024

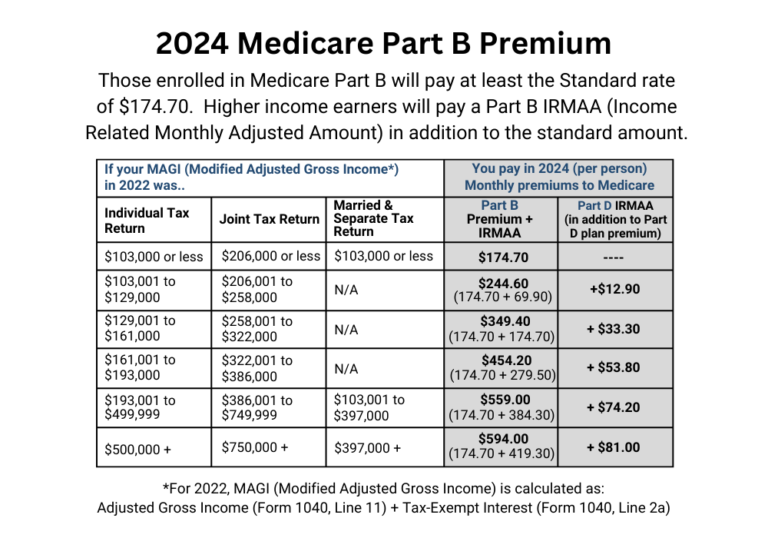

2024 Part B Premium

The standard Part B premium amount in 2024 is $174.70. Most people pay the standard Part B premium amount. If your modified adjusted gross income, as reported on your IRS tax return from 2 years ago, is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Income Related Monthly Adjustment Amount for 2024 (IRMAA)

Find your income level below according to how you filed in 2022 to see what you will pay for 2024

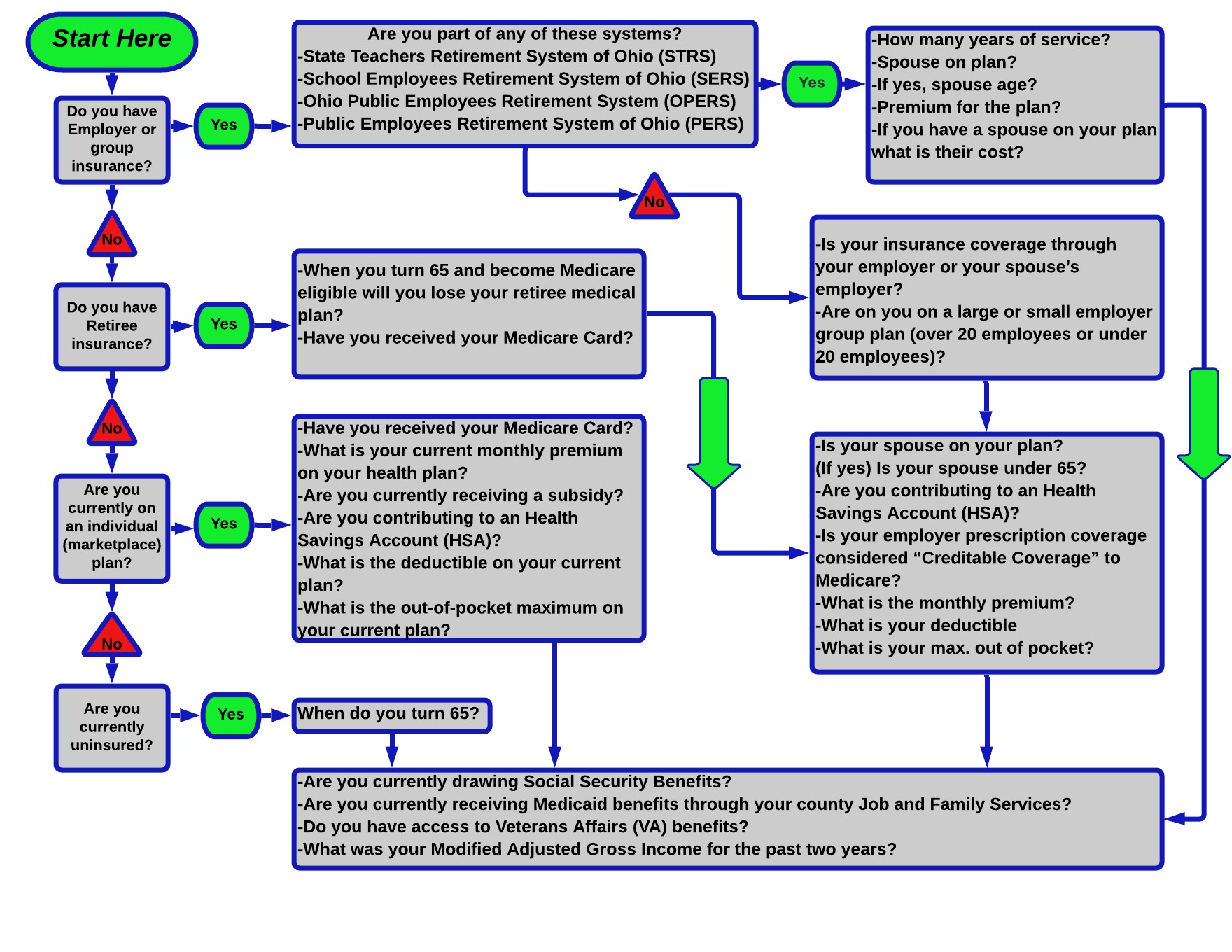

Medicare Questionaire Flow Chart

The Turning 65 Checklist

Here are step-by-step instructions to make it easier for you to receive your full Medicare benefits. The following are steps you should take leading up to turning age 65. Some steps are required while others are suggested to make the transition easier.

Four Months Before You Turn 65

Confirm that you are eligible to receive Medicare benefits by calling the Social Security Administration at (800) 772-1213. Some individuals may or may not qualify for certain benefits depending on the number of years you or a spouse paid Medicare and Social Security payroll taxes, however, if you’re disabled or meet other requirements you may also qualify. This is an important first step.

If you are currently receiving early retirement Social Security benefits, then you will automatically be enrolled for Medicare Part A and Part B. If this is the case you will receive your Medicare card 3 months prior to your 65th birthday and no further action is required to obtain your Medicare card. If this is your situation skip the next step.

If you are NOT currently receiving Social Security benefits, then go to www.Medicare.gov to apply for Medicare benefits or visit your local Social Security office to apply in person. You can find your local Social Security office by searching on Google or looking in your phone book.

Review your current health insurance policy to find out what happens with that coverage when you turn 65. If you’re currently covered under an employer group plan check with the HR department to see how your benefits will change. If you are covered under an individual policy, then review your current insurance coverage to see how your benefits will change when you turn 65.

Call your Medicare advisor to review Medicare supplements, advantage health plans, and prescription drug plans to see what makes sense for you and your situation. It is essential to enroll in a supplemental health plan at this point to ensure that coverage starts at age 65.

Confirm that you receive your supplemental health plan card three weeks after enrolling in a Medicare Health Plan. If you have not received your card after three weeks contact your Medicare advisor.

Confirm that you receive your Medicare card 2 months prior to your 65th Birthday. If you have not received your Medicare card at this point call the Social Security Administration at (800) 772-1213.

Claim your Social Security benefits.

You can claim your Social Security retirement at various times. Obtaining your full Social Security benefits, or reaching full retirement age, depends on your year of birth. At that time, you can earn an income and not be penalized. However, you can claim reduced benefits as early as age 62. Or, you can wait until age 70 and claim greater benefits. Please note that while you are able to file for Social Security benefits at age 62, this does not qualify you to receive Medicare benefits at age 62. When you are ready to start this process call Social Security Administration at (800) 772-1213.

Check on eligibility for financial assistance.

When you turn 65, if you have only a few assets and/or they are of minimal value, (not including your home), and your income meets federal or state minimum requirements, you may qualify for medical and financial assistance. Through Medicaid, you can be fully covered for the costs of health care, long-term home care and, if you qualify, nursing home residence care. In addition, you may qualify for Supplemental Security Income, which is a small monthly cash assistance. To find out if you qualify for extra assistance, call your Medicare advisor and they can direct you, to the help you need.

Prepare legal documents.

If you haven’t already, this is a good time to get your legal documents in order (such as a will, power of attorney for finances, or living will). Even though you have many years to live, decision making could become difficult due to a sudden change of events. That’s why it’s important to make your health care, end of life care, financial and estate decisions now.

Would you like for Suzanne and her team help guide you through the Medicare Maze? Please give our office a call at (614) 448-1834 or email Suzanne at Suzanne@nuMedicareAdvsiors.com

Thanks for stopping by!